Marijuana Industry Could Be Worth $35 Billion By 2020,

If All States And Feds Legalize It

If all 50 states legalized marijuana and the federal government ended prohibition of the plant, the marijuana industry in the United States would be worth $35 billion just six years from now. That’s according to a new report from GreenWave Advisors, a research and advisory firm that serves the emerging marijuana industry in the U.S., which found that if all 50 states and the federal government legalized cannabis, combined sales for both medical and retail marijuana could balloon to $35 billion a year by 2020.

If the federal government doesn’t end prohibition and the trajectory of state legalization continues on its current path, with more, but not all, states legalizing marijuana in some form, the industry in 2020 would still be worth $21 billion, GreenWave projects. In its $21 billion 2020 model, GreenWave predicts 12 states plus the District of Columbia to have legalized recreational marijuana (besides Colorado and Washington, which legalized it in 2012). Those states are: Alaska, Arizona, California, Hawaii, Maine, Maryland, Massachusetts, Nevada, New Hampshire, Oregon, Rhode Island and Vermont, according to data GreenWave provided to The Huffington Post from the full report. By that same year, the model assumes, 37 states will have legalized medical marijuana. To date, 23 states and the District of Columbia have legalized marijuana for medical use.

“Our road map for the progression of states to legalize is very detailed –- our assumptions are largely predicated on whether a particular state has legislation in progress,” Matt Karnes, founder and managing partner of GreenWave as well as author of the report, told HuffPost. “We assume that once legalization occurs, it will take a little over a year to implement a program and have product available for sale. So for example, for Florida, we expect the ballot measure to pass [this year] yet our sales forecast starts in year 2016. We think the time frame will lessen as new states to legalize will benefit from best practices.”

As Karnes noted, some of these states are already considering legalization this November — voters in Oregon, Alaska and D.C. are considering measures to legalize recreational marijuana, while Florida voters will weigh in on medical marijuana legalization. GreenWave isn’t the first group to suggest the federal government may end its decadeslong prohibition of marijuana. One congressman has even predicted that before the end of the decade, the federal government will legalize weed. And as outlandish as it may sound, it’s already possible to observe significant shifts in federal policy toward pot.

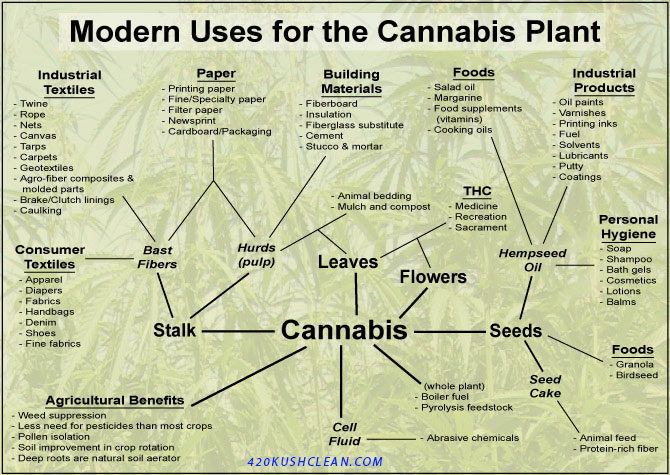

The federal government allowed Colorado’s and Washington’s historic marijuana laws to take effect last year. President Barack Obama signed the 2014 farm bill, which legalized industrial hemp production for research purposes in the states that permit it, and the first hemp crops in U.S. soil in decades are already growing. And in May, the U.S. House passed measures attempting to limit Drug Enforcement Administration crackdowns on medical marijuana shops when they’re legal in a state.

The federal government allowed Colorado’s and Washington’s historic marijuana laws to take effect last year. President Barack Obama signed the 2014 farm bill, which legalized industrial hemp production for research purposes in the states that permit it, and the first hemp crops in U.S. soil in decades are already growing. And in May, the U.S. House passed measures attempting to limit Drug Enforcement Administration crackdowns on medical marijuana shops when they’re legal in a state.

The GreenWave report also projects a substantial shift in the marijuana marketplace — the merging of the medical and recreational markets in states that have both. “In the state of Colorado, we are beginning to see the sales impact — i.e., cannibalization of medical marijuana sales by the adult-use market — when the two markets co-exist,” Karnes said. “We expect a similar dynamic to unfold in those states that will implement a dual marijuana market.”

Beginning in July, recreational marijuana sales in Colorado began to outpace medical for the first time, according to state Department of Revenue data. Karnes writes in the executive summary that just what the marijuana industry will look like in 2020 will largely depend on how the industry is regulated and how it is taxed by that time.

“Since ‘chronic pain’ is the most common ailment among medical marijuana users, it is likely that recreational users can already purchase marijuana without great difficulty in states where medicinal use is legal,” the report reads. “Accordingly, it can be argued that a merged market already exists in medical marijuana states. Less currently popular, but arguably providing more economic stimulus, would be a regulatory regime providing for only adult recreational use.”

Source: Huffingtonpost.com

Author: Matt Ferner